colorado electric vehicle tax credit form

2021 Claim for Refund on Behalf of Deceased Taxpayer. Repeal fuel tax increases and vehicle fees that were enacted in 2017 including the Road Repair and Accountability Act of 2017 and.

Electric Vehicle Tax Credits On Irs Form 8936 Youtube

The fee will be 285 effective June 1 2022.

. 2021 Tax Credit. Nelnet Business Services charges a nonrefundable 275 service fee for each transaction using this payment method. There is no estate or inheritance tax in Colorado.

In the event you recieve an electric vehicle state tax credit from the state of colorado for the purchase of an ev and also receive an ev. Credit or debit card from American Express Mastercard Visa or Discover. Require voter approval via ballot propositions for the California State Legislature to impose increase or extend fuel taxes or vehicle fees in the future.

2021 Tax Credit. 2021 Tax Credit. A yes vote supported this initiative to.

If you are purchasing a new or used vehicle from a Colorado dealer the dealer will provide the Manufacturers Statement of Origin or Title with any supporting documents needed along with a DR2395 Application for Title a DR0024 Sales Tax Receipt a DR2407 Dealers Bill of Sale and if the title is from out of state they should include a. More specifically marijuana retailers must pay a 15 excise tax when they buy from a cultivator leaving consumers to pay the other 15 in the form of a sales tax at the time of purchase. The 29 state sales tax rate only applies to medical marijuana.

Is there a limit on how much you can earn with the Electric vehicle tax credit. Credit or debit card - Use a US. 10-12 EV credits in 2019-2020 and 14-18 in 2021-2023.

Then together with your tax return you should complete Form 8936. Colorado the Northeast and the West Coast in general have the most generous programs. Its also expensive with a 69100 base price and a loaded tab that brushes 83000 though buyers can get a 7500 federal tax credit which makes the top-end price more competitive.

Leading states such as California and New York offer subsidies and tax incentives and collaborate with electric utilities to promote EV deployment. Colorado Connecticut Maine Maryland Massachusetts New Jersey New York. Credit For Solar Energy Credit.

By accepting the ev rebate you shall not claim and agree to forfeit your right to any such tax rebate from the state of colorado. Nonrefundable Individual Tax Credits and Recapture. The Electric vehicle tax credit has no income restriction but you would have to have a federal.

Any state of colorado tax credit applicable to customers purchase of an ev. New Energy Vehicle dual credit system. Credit for Contributions Made or Fees Paid to.

4 Things You Need To Know About The Ev Charging Tax Credit The Environmental Center

Tax Credits Drive Electric Colorado

Electric Vehicle Tax Credits What You Need To Know Edmunds

Tax Credits Drive Electric Colorado

Electric Car Tax Credit What Is Form 8834 Turbotax Tax Tips Videos

Colorado Ev Incentives Ev Connect

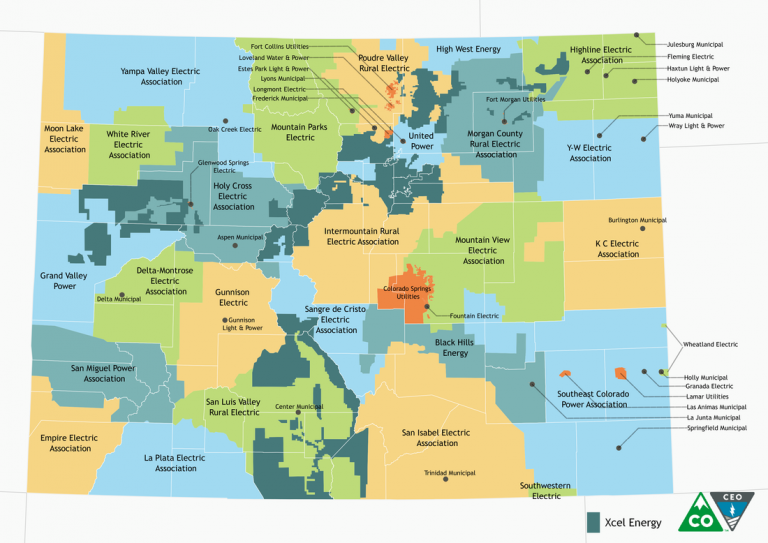

Utilities Rebates Incentives Drive Electric Colorado

Electric Vehicles Charge Ahead In Statehouses Minnesota Reformer

Filing Tax Form 8936 Qualified Plug In Electric Drive Motor Vehicle Credit Turbotax Tax Tips Videos

Electric Cars The Surge Begins Forbes Wheels

Rebates And Tax Credits For Electric Vehicle Charging Stations

How Do Electric Car Tax Credits Work Credit Karma

Zero Emission Vehicle Tax Credits Colorado Energy Office

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek