inheritance tax changes budget 2021

The government has announced that the inheritance tax IHT threshold will remain frozen at 325000 until 20252026. Tax rates and allowances.

How Is Tax Liability Calculated Common Tax Questions Answered

Changes To Inheritance Tax for Budget 2022.

. In a nutshell everything remains the same. This could result in a significant increase in CGT rates if this recommendation is implemented. The personal allowance will increase to 12570 from 12500 for the 202122 tax year and the basic-rate band will increase to 37700 from 37500.

Here are our key takeaways from the Autumn Budget 2021 for Inheritance tax. Inheritance tax thresholds are also being held at their current levels for. 5 Budget tax changes 2021 and how they will affect your finances.

However if the beneficiarys net. In addition the residence nil-rate. Budget 2021 - Changes to Inheritance Tax Posted on 29th April 2021 at 1236 With the Chancellor announcing in the budget this year that the inheritance tax thresholds will be.

It includes measures to. If the inheritance tax is paid within nine months of date of decedents death a 5 percent discount is allowed. Therell be a 40 charge on the remaining 25000 giving a total of 10000 in tax presuming youre not leaving anything to charity.

The following tax changes were announced by Deputy Prime Minister and Minister for Finance Mr. Following the release of Budget 2022 the 3 main thresholds remain as they were as. Mr Sunak will update any changes to Inheritance.

Budget 2021 announced 13 October 2020 featured record government expenditure of over 17bn against a backdrop of COVID-19 and Brexit. Taxes are never popular but Inheritance Tax IHT is arguably subject to more criticism than any other. Inheritance and Estate Taxes are two separate taxes that are often referred to as death taxes since both are occasioned by the death of a property owner.

The current inheritance tax allowance for an individual on death is 325000 the nil rate band subject to any chargeable lifetime gifts. If you werent leaving your home to your direct. Inheritance Estate Tax.

Much has been made of the Autumn Budget and the changes around Universal Credit and National Insurance but changes to other taxes are sometimes missed when reviewed by the media. Proposed changes to Capital Gains Tax. Unsurprisingly given the ongoing pandemic a large part of the Chancellors speech was focused on the continued provision of Government.

January 2022 Inheritance Tax Changes All You Need To Know. Inheritance Tax changes. Heng Swee Keat in his Budget Statement for the.

27 October 2021 3 min read Share Chancellor Rishi Sunak largely resisted the temptation to tinker with pension and inheritance taxes to fund his spending plans in his. 0818 Wed Oct 27 2021. Budget 2021 - Changes to Inheritance Tax.

Ad Inheritance and Estate Planning Guidance With Simple Pricing. Budget 2021 has been announced. Gifts to a spouse and also to charities.

The tax free nil rate band has been fixed at 325000 since 2009 with the residential nil rate band being introduced in 2017 and currently set at 175000. Chancellor Rishi Sunak walking tax tightrope to balance Budget RISHI SUNAK has announced the Budget for 2021 and Inheritance Tax has featured in. The Treasury is reportedly looking to hike its tax intake in this Autumn Budget with Inheritance Tax.

With the Chancellor announcing in the budget this year that the inheritance tax thresholds will be frozen at the existing levels until April 2026 have you made the most of your tax free. The tax due should be paid when the return is filed. Posted on 29th April 2021 at 1236.

The changes in tax rates could be as follows. For 2021-22 youll be charged at 10 on the first 1m of gains when selling a qualifying business the same as the 2020-21 tax year. Rishi Sunaks second Budget of 2021 was largely about spending with little movement on personal tax - notably absent again was any mention of capital gains tax.

1723 3 Mar 2021. Budget 2021 - Overview of Tax Changes. This is called entrepreneurs relief.

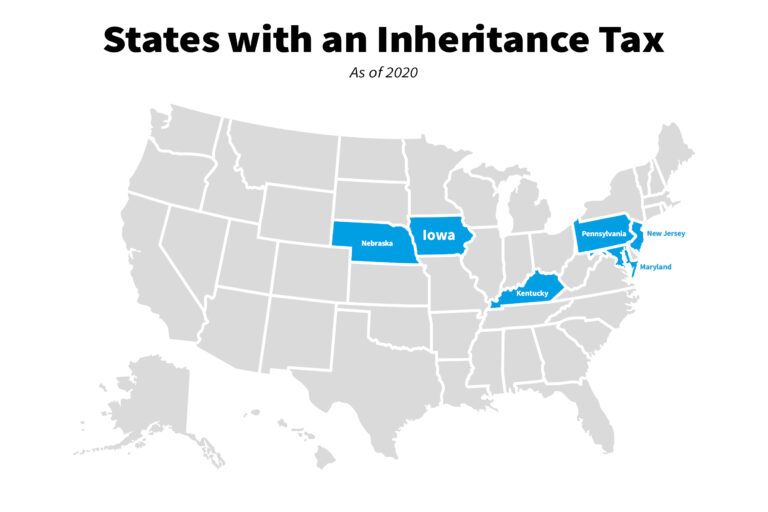

3 Reasons Why Almost Every State Except Nebraska Ended Its Inheritance Tax

Death Tax Also Known As Inheritance Tax Bishop Collins

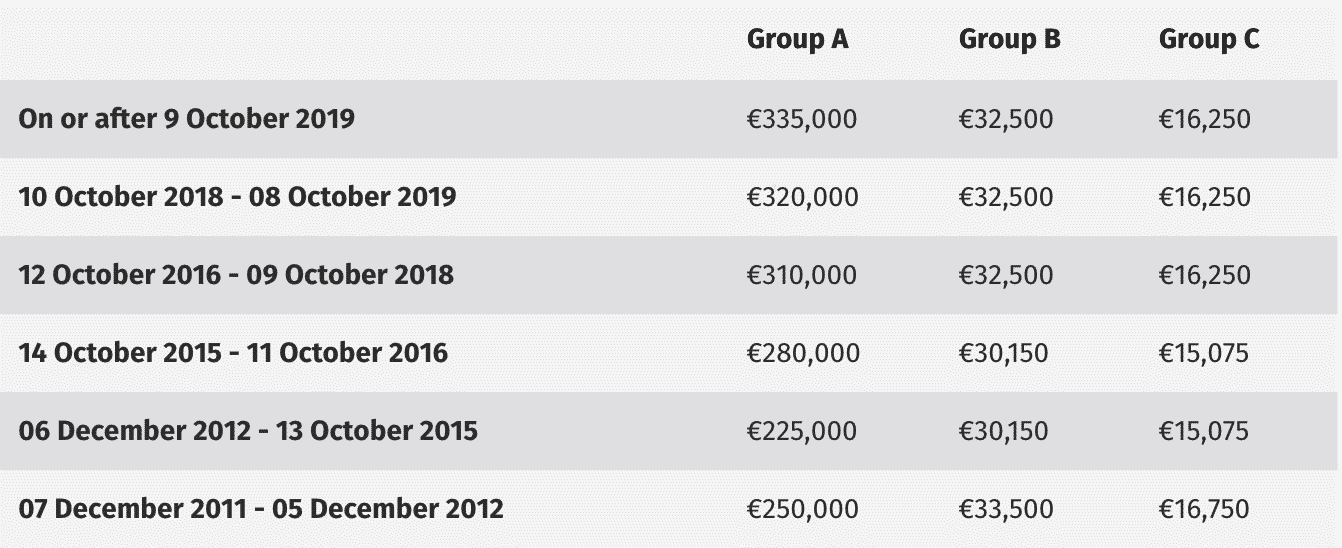

Simple Legal Ways To Avoid Inheritance Tax In Ireland Today

States With No Estate Tax Or Inheritance Tax Plan Where You Die

The Proposed Changes To Cgt And Inheritance Tax For 2021 2022 Bph

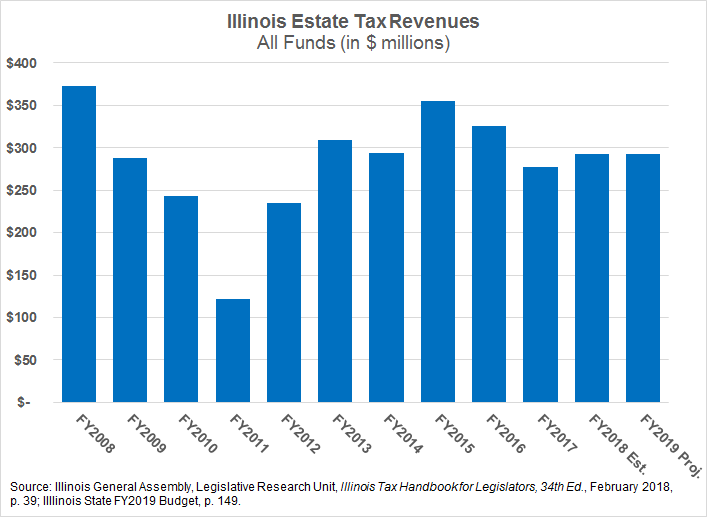

Whither The Illinois Estate Tax The Civic Federation

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Eliminate Iowa S Inheritance Tax Iowans For Tax Relief

Is There A Federal Inheritance Tax Legalzoom Com

States With No Estate Tax Or Inheritance Tax Plan Where You Die

2021 Victory Inheritance Tax Eliminated Iowans For Tax Relief

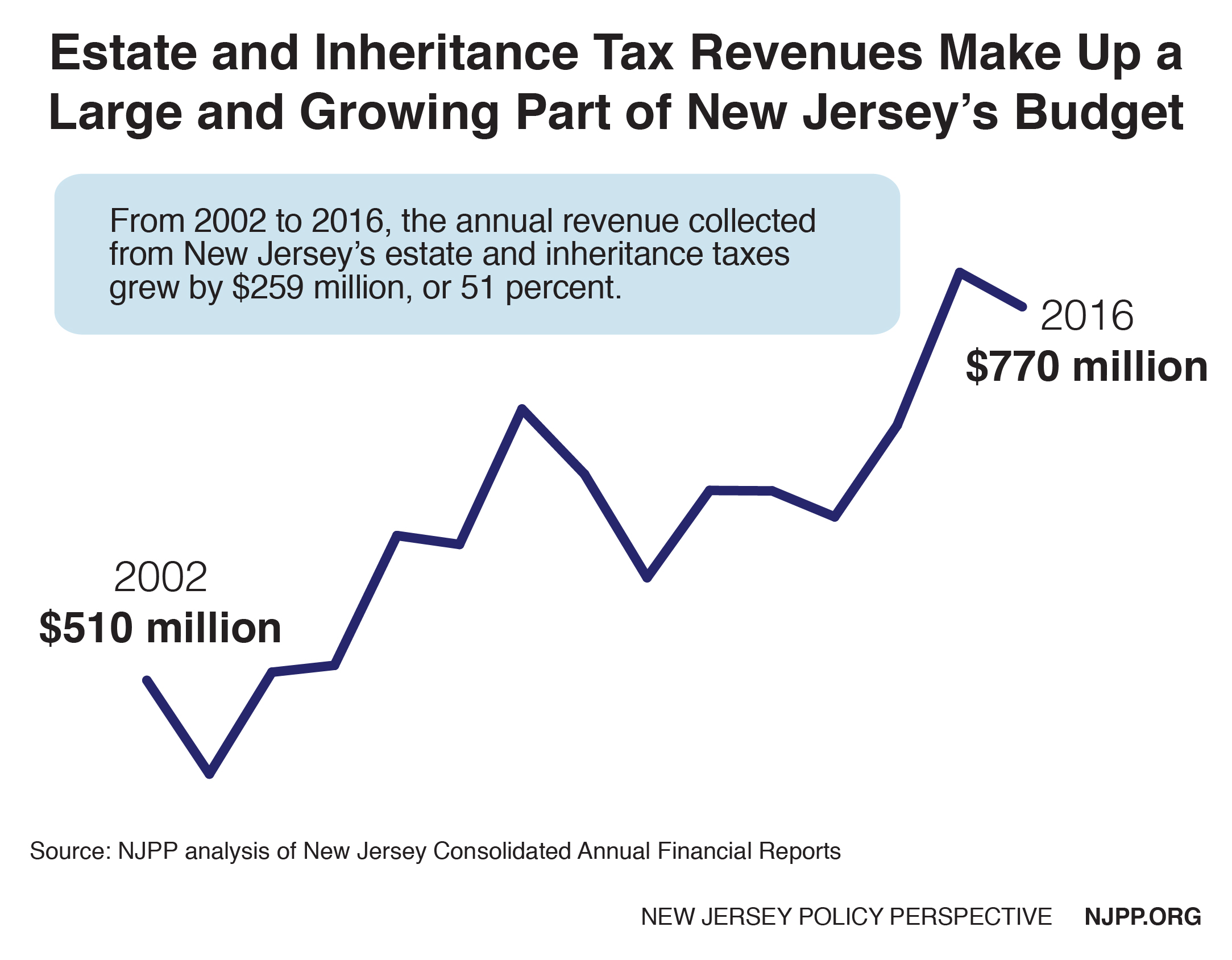

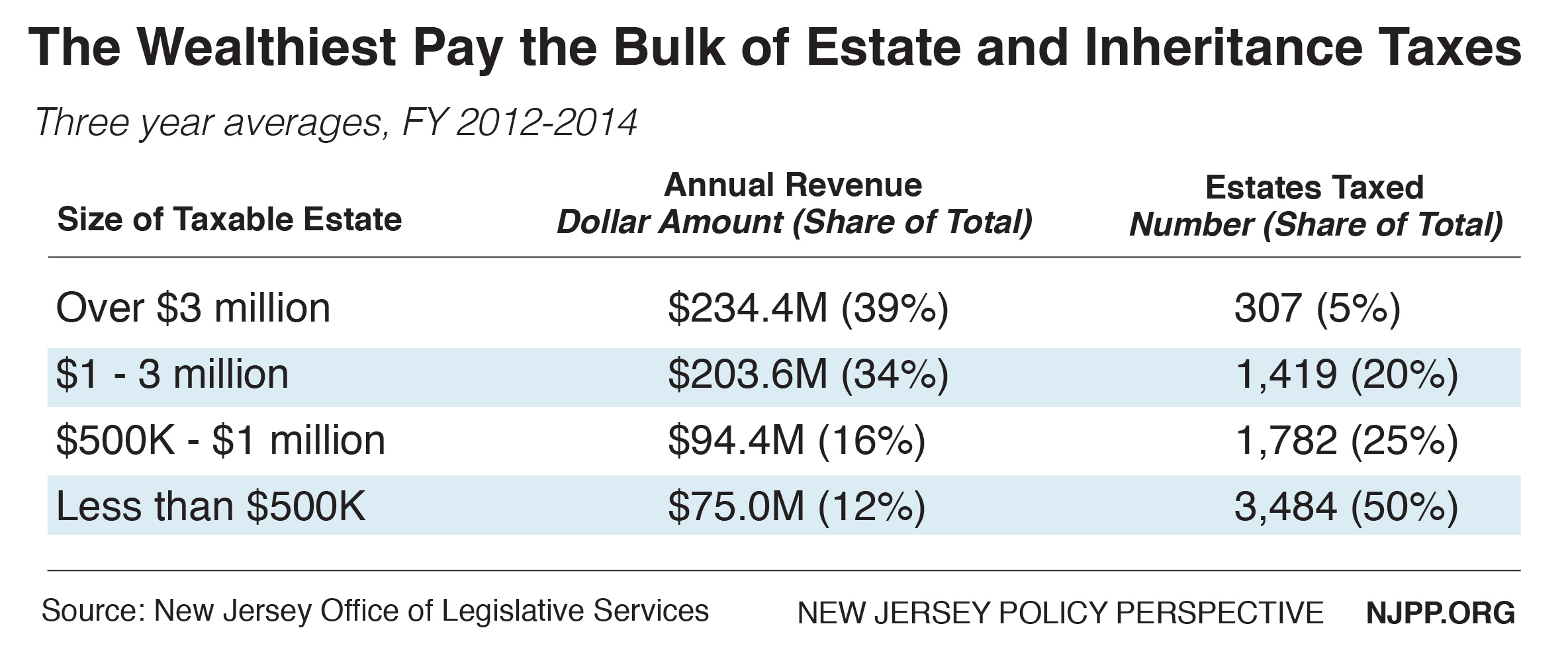

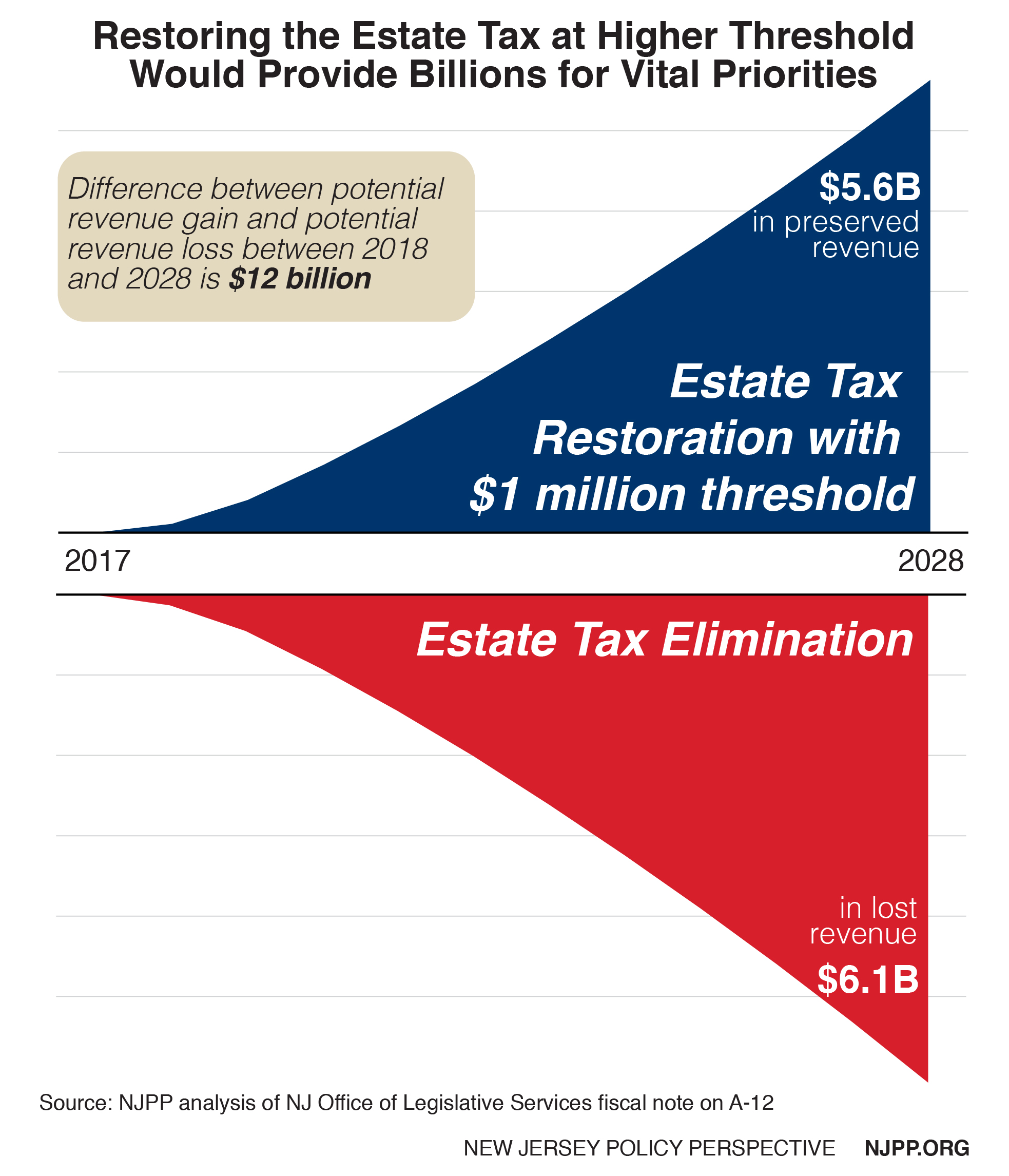

Fairly And Adequately Taxing Inherited Wealth Will Fight Inequality Provide Essential Resources For All New Jerseyans New Jersey Policy Perspective

Potential Impact Of Estate Tax Changes On Illinois Grain Farms Farmdoc Daily

Fairly And Adequately Taxing Inherited Wealth Will Fight Inequality Provide Essential Resources For All New Jerseyans New Jersey Policy Perspective

How Do State Estate And Inheritance Taxes Work Tax Policy Center

The Silver Spoon Tax How To Strengthen Wealth Transfer Taxation Equitable Growth

Fairly And Adequately Taxing Inherited Wealth Will Fight Inequality Provide Essential Resources For All New Jerseyans New Jersey Policy Perspective

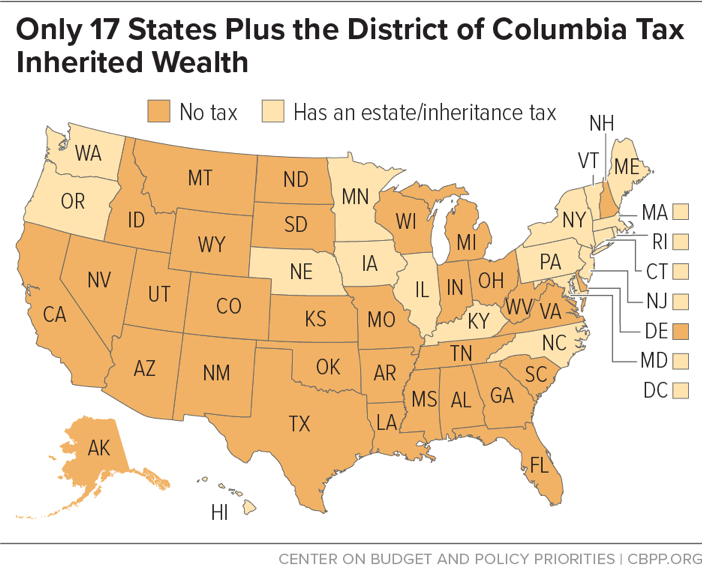

Only 17 States Plus The District Of Columbia Tax Inherited Wealth Center On Budget And Policy Priorities

To Climb Tax Rankings Minnesota Can Reform Its Property Tax Base American Experiment